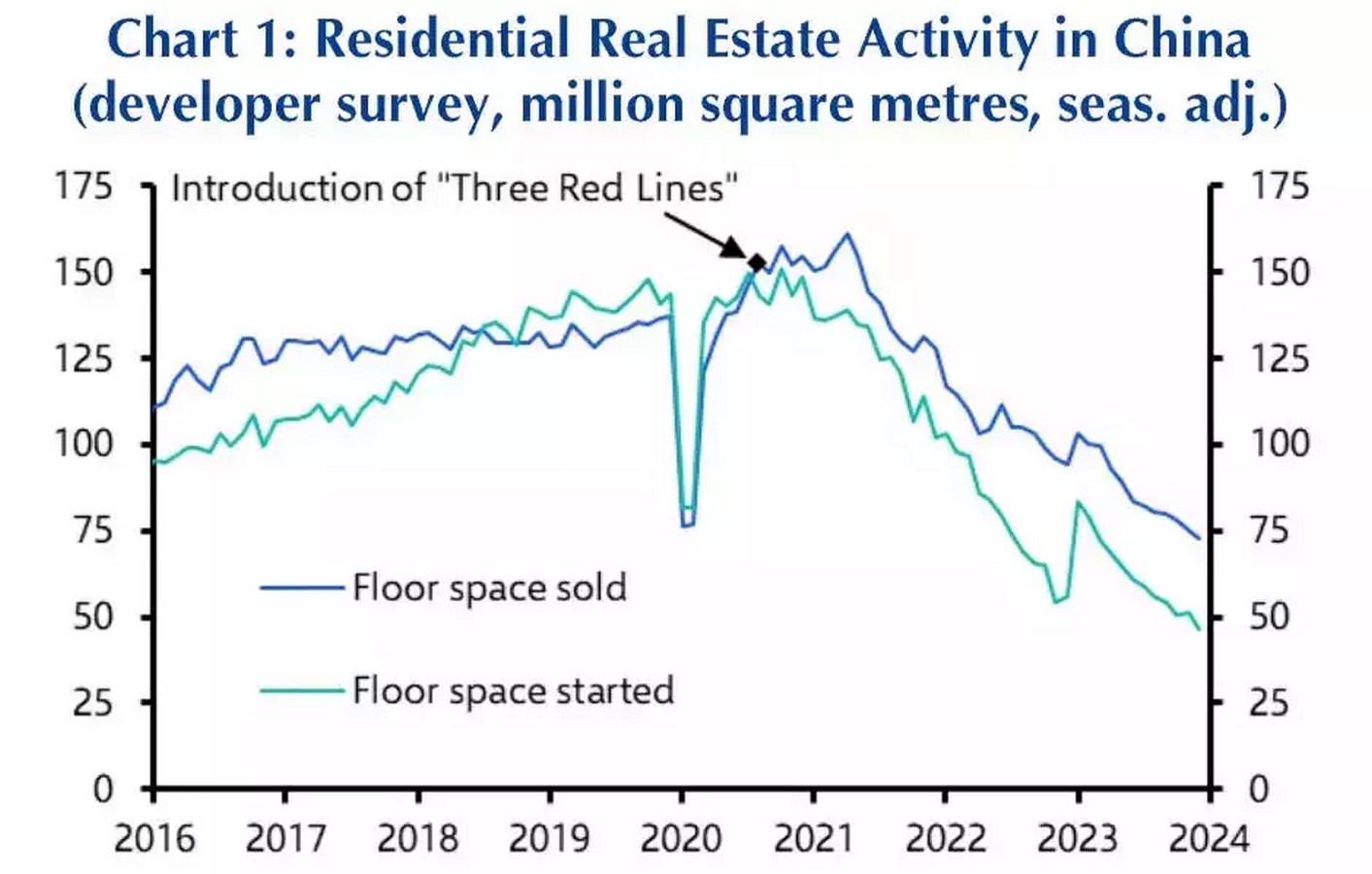

China’s real estate market, in a prolonged state of decline for several years, may be on the brink of further deterioration as construction enters a deeper correction phase, according to insights from Capital Economics.

Sustained Slump in Construction

Despite noticeable declines in property sales and construction starts, sustained construction activity has persisted due to increased investment from Beijing and pressure on developers to complete existing projects. However, Capital Economics suggests that the current level of residential construction activity is unsustainable given China’s demographics and the need for housing stock replacement.

Gradual Decline in Construction

While floor area under construction has decreased by only 3% since its peak in 2022, significant infrastructure support has prevented a more substantial decline. Investment in infrastructure has expanded, potentially mitigating further softening in construction output.

Opaque Real Estate Metrics

Real estate construction data in China remains opaque, lacking sufficient details to provide a clear understanding of the sector’s performance. Despite apparent weaknesses in new building activities, much of the data does not offer comprehensive insights.

Economic Impact of Construction Slowdown

Real estate has traditionally been a significant contributor to China’s economic growth, but the ongoing contraction in the sector has not yet translated into a significant drop in construction activity. Capital Economics anticipates that Beijing will prolong the downturn to minimize its immediate impact, potentially stretching until 2030 and reducing GDP growth by about 1% over the decade.

Structural Challenges Ahead

Despite efforts to bolster the sector through investment and regulatory pressure, underlying weaknesses in property demand persist. Demographic trends, including population decline and stagnant urbanization, suggest subdued property demand in the foreseeable future.

Unfolding Economic Implications

While property sales and project initiations have plummeted, and many developers have faced bankruptcy, the full extent of China’s real estate crisis on economic activity remains unrealized. Capital Economics warns that the lingering effects of the property downturn are yet to fully materialize.

In conclusion, China’s real estate market faces a challenging road ahead, with structural issues and demographic trends likely to exacerbate the ongoing downturn despite government interventions.

Leave a Reply